When an item is assembled. It takes on the cost of the pieces that make up the parent.

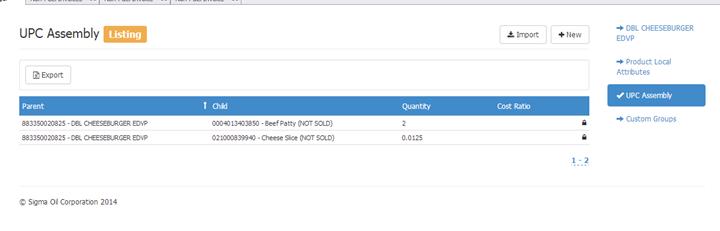

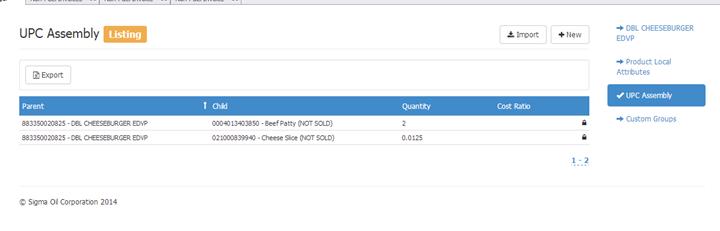

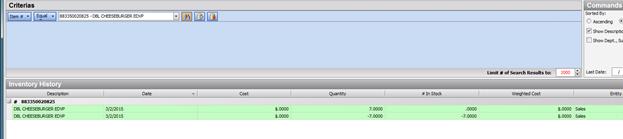

EX: DBL CHEESEBURGER EDVP

The DBL CHEESEBURGER is assembled to the SKU for a block of cheese and to a box of beef patties that are purchased. Each time a double cheeseburger is sold, inventory is reduced by 2 for a beef patty and .0125 for a slice of cheese based on the ratio for the qty that makes up the item sold.

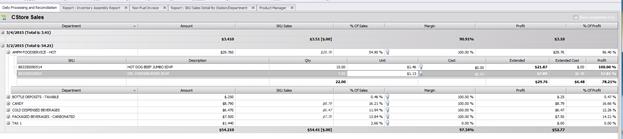

In this example, 7 dble cheeseburger items were sold below:

The parent never has ANY in inventory, inventory is always carried on the child units. So S2K shows 7 sold, then reduces by 7 and splits to the children according to ratio.

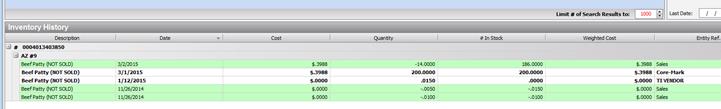

And inventory was depleted accordingly:

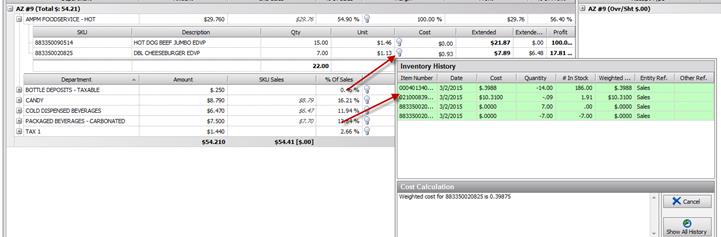

The cost of the item when sold will also reflect that portion of the child item. By right clicking on the lightbulb you can see the cost history, in this example the cost of the dble cheeseburger is showing $.93 based on the cost of the children that makes it.

Patty Cost = 2 patties @ $.3988 each = $.80

Cheese Cost = .0125 (2/160th of a brick) x $10.31 = $.13

Total cost = $.93

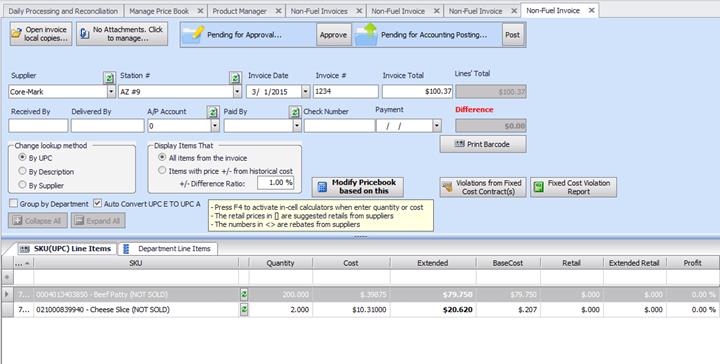

Cost is from invoice below:

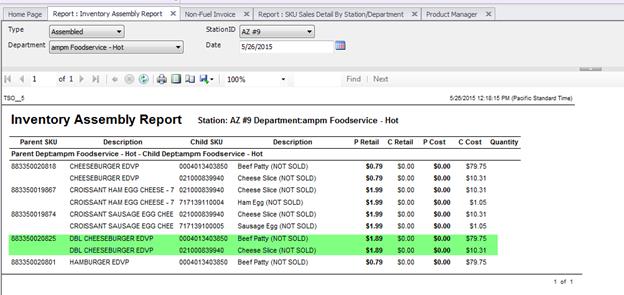

You can see assembled items and their purchased cost under the Inventory Assembly report in REPORTS> Non-Fuel Inventory > Inventory Assembly Report. NOTE: This report only shows PURCHASED COST for parent and child. Does not reflect average costs for recipe. Currently we do not have any recipe reports to show you how cost and profit is calculating.